The second day started with the keynote speech of Hans-Christian Holte, President of the Norwegian Tax Administration who spoke on the vision of Norway in making tax administration digital. He emphasized that digitalisation must be integrated in the business strategy. As the Chair of Forum on Tax Administrations (FTA/OECD) he expressed that digitalisation is one of three prioritised areas for the work of FTA.

Photo: Hans-Christian Holte

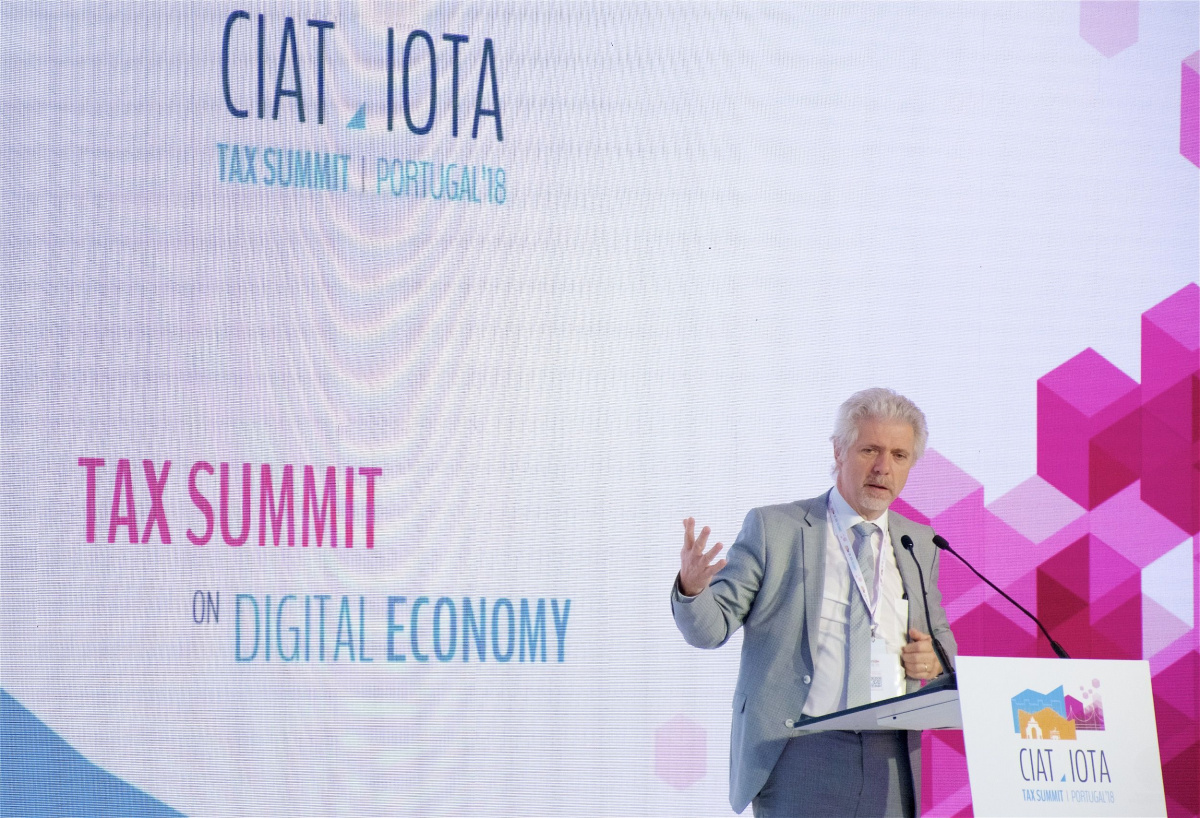

Hans D'Hondt, President of IOTA, President of the Belgian tax administration in commenting the keynote speech highlighted data analytics, social network analysis and machine learning among important aspects of digitalisation. Michael Snaauw, President of CIAT, Assistant Commissioner of the Canada Revenue Agency in his comments shared the digital modernization strategy and achievements of Canada Revenue Agency.

Hans D'Hondt, President of IOTA, President of the Belgian tax administration in commenting the keynote speech highlighted data analytics, social network analysis and machine learning among important aspects of digitalisation. Michael Snaauw, President of CIAT, Assistant Commissioner of the Canada Revenue Agency in his comments shared the digital modernization strategy and achievements of Canada Revenue Agency.

A session on real-time controls for tax administration purposes provided a broad view of country experiences from the United States, Russia, Portugal and Argentina. Supply chain control and AEOI, the potential of the Internet of Things, on-line cash registers were among many issues presented.

Photo: Hans D'Hondt

How the new technologies are changing the relation between tax administrations and taxpayers was discussed in the next panel. A new electronic tax clearance system in Ireland and the service provided by the Finnish tax administration for startups in Finnish, Swedish, English and even in Chinese were presented. E-social system in Brasil and the use of e-invoice data in Mexico were also shared with participants.

How the new technologies are changing the relation between tax administrations and taxpayers was discussed in the next panel. A new electronic tax clearance system in Ireland and the service provided by the Finnish tax administration for startups in Finnish, Swedish, English and even in Chinese were presented. E-social system in Brasil and the use of e-invoice data in Mexico were also shared with participants.

Human resources and capacity building was the subject of the next session. Main challenges in recruiting young talents in a highly competitive market and the value proposition of the tax administration was explained by the representative of the Netherlands. Is it possible to transform tax administration officials into data scientists? – The question was raised by the Irish speaker emphasizing that a deep understanding of data and good data quality are vital to success. Alejandro Juarez from CIAT highlighted the benefits and risks of long-term stability.

Kunio Mikuriya, Secretary General of the World Customs Organisation moderated a round table discussion on main challenges tax and customs administrations are facing in the digital environment.

The session on advanced analytics for compliance control included the experience of Belgium about using advanced data analytics to predict debt non-payment risks, how data science becomes the primary decision-making tool the Revenue Service of USA, how Spain is using Big Data tools and what are the lessons learned from Machine learning in Estonia.

Raul Zambrano, Director of Technical Assistance in CIAT opened the last day of the Summit with a keynote speech in which he shared his inspiring thoughts about challenges and opportunities of tax digitization.

How the technology is used to support HMRC's 'Promote, Prevent, Respond' strategy for compliance activity in United Kingdom, the use of electronic invoice in Latin America, the experience of Portugal with SAF-T, use of new technologies for tax compliance in Canada and the e-invoice in Chile were shared in the next panel.

How the technology is used to support HMRC's 'Promote, Prevent, Respond' strategy for compliance activity in United Kingdom, the use of electronic invoice in Latin America, the experience of Portugal with SAF-T, use of new technologies for tax compliance in Canada and the e-invoice in Chile were shared in the next panel.

Miguel Silva Pinto, Executive Secretary of IOTA moderated a discussion on views and perspectives of the business community on tax digitization with the participation of business representatives from Microsoft, Vertex, Accenture, Fintech, Sovos. Use on real time reporting for tax administrations, potential of artificial intelligence in the digitization of tax administrations and how businesses can help tax administrations on their modernization process were among the issues presented and discussed.

Tax administrations in 10 - 15 years, how we are coping with the pace of change was the subject of a high-level panel discussion moderated by Helena Borges, Director General of the Portuguese Tax and Customs Authority. Participants could hear the views of Georgios Pitsilis, Governor of the Independent Authority for Public Revenue of Greece, Fernando Barraza, Commissioner from Chile, Mikayil Jabbarov, Minister of Taxes of the Republic of Azerbaijan, Edgar Morales from the Dominican Republic (Large Taxpayers Manager) and Alvaro Romano Deputy Director General from Uruguay.

The Summit’s last session was an informal panel discussion with some members (CIAT and IOTA) and the Secretariat of the NTO - Network of Tax Administrations. Panel members agreed that extending the knowledge and experience gathered in each organisations by sharing publications, participating in each other’s events, harmonizing calendars will maximize joint efforts. NTO will take international cooperation between regional tax organisations even further.

The Summit’s last session was an informal panel discussion with some members (CIAT and IOTA) and the Secretariat of the NTO - Network of Tax Administrations. Panel members agreed that extending the knowledge and experience gathered in each organisations by sharing publications, participating in each other’s events, harmonizing calendars will maximize joint efforts. NTO will take international cooperation between regional tax organisations even further.